Canada is a preferred destination for foreign enterprisers who can set up various types of companies here. The corporation is the most popular type of structure used here as it resembles the limited liability company in European countries. However, there is also a large portion of investors interested in setting up holding companies. Canada is one of the countries where the concept of holding company is accepted. The taxation system allows for the establishment of holding companies under very advantageous conditions in Canada. Our company formation consultants in Canada can offer information about the holding company.

| Quick Facts | |

|---|---|

| Legal entities used | Corporation |

|

Incorporation method |

The standard registration process applicable to Canadian businesses |

|

Incorporation time |

Between 5 and 30 days, depending on the Canadian province |

| Advantages |

– asset protection, – tax advantages, – capital gains exemptions, – estate planning, – reduced exposure to risk |

| Precautions |

– incorporation costs can be high, – operating costs can be high, – complex administrative procedures |

| Shareholding structure |

The holding company owns at least 50% of the shares of another company. |

| Minimum Capital |

no capital requirements |

| Taxation | Corporate taxes are applied, but there are certain tax exemptions (on capital gains, the small business deduction and others) |

| Control | The holding controls the management of its subsidiaries, but it does not engage in their activities. |

| Accounting and Reporting |

There is an obligation to submit yearly accounting files with the tax authorities. |

| Number of double taxation treaties | 94 |

What is a Canadian holding company?

The holding company is an entity which is created for the purpose of gathering various assets such as real estate, shares, assets or even other companies under one umbrella, or better said under another company which has control over these.

There are several types of holding companies which can be registered in Canada, among which the most popular one is the investment holding. Also, Corporations Canada (the institution in charge with company registration) recognizes holding companies.

How to set up a holding company in Canada

The registration process of a holding company is no different from that of starting a company in Canada. The first step is to choose whether the company will be registered at a federal or regional level, followed by the company name reservation with the Trade Register. However, instead of a name, the Canadian holding can be issued a unique number.

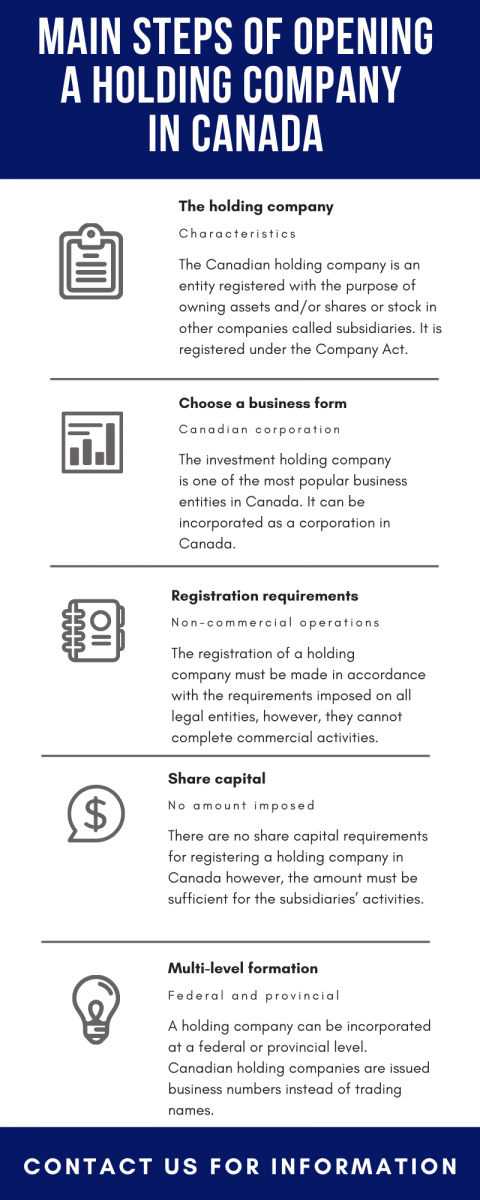

Our Canadian company formation agents can assist with the registration of a holding company. You can read about the main steps of setting up a holding company in Canada in the scheme below:

What are the main steps of registering a holding company?

In order to register a business in Canada as a holding, investors will need to go through the basic incorporation steps regulated by the national law. In the list below, you can discover the general steps for the registration:

- decide on a legal entity and a company name (steps imposed for all businesses during the set up of a company in Canada);

- complete the mandatory registration formalities with local institutions (the procedures are initiated with Corporations Canada);

- apply for a tax registration number and open a corporate bank account;

- once the company is active, it can engage in the purchase of shares in other companies.

Advantages of holding companies in Canada

There are various advantages to holding company registered in Canada. These benefits depend on how the company is registered: as an investment holding or as an operating holding. Those who set up holding companies in Canada will mainly benefit from:

- enhanced protection against creditors;

- capital gains tax exemptions;

- dividend tax exemptions.

What are the accounting obligations of Canadian holding?

Considering that the holding is set up so that it can gain a profit from its activities, the company is liable to the payment of various taxes. This is why, during the process of company incorporation in Canada, the holding company is required to register for taxation and obtain a tax number.

As a taxpayer, the holding must comply with different accounting requirements, which must be conducted by professionals in the field, such as our team of accountants in Canada. There are many obligations to fulfill. For instance, the company must maintain all its financial transactions and prepare financial reports.

The company must prepare, for the end of the fiscal year, financial statements, which, in this case, are comprised of the following documents (they can sometimes vary based on the type of company and its size):

- income statement;

- cash flow statement;

- the balance sheet.

In Canada, the accounting legislation prescribes 2 types of financial statements – simplified or consolidated. In some cases, the holding must prepare consolidated financial statements. Audit can also be necessary in certain circumstances.

The manner in which accounting formalities are completed varies, also, based on the size of the company, and here, the holding has 3 options:

- the Canadian General Accepted Accounting Principles;

- the International Financial Reporting Standards (IFRS);

- the Accounting Standards for Private Enterprises.

If you open a company in Canada as a holding, you must also know the following:

- in the case in which the holding owns more than 50% of the shares of another company, the law considers that the holding has control over the latter company, therefore, from an accounting point of view, it will be obligated to prepare consolidated financial statements;

- for corporate entities, the financial year can vary, thus, in some cases it can be the calendar year (1st January to 31st December) or it can be calculated from the date when the company started its operations, with a duration of maximum 53 weeks;

- it must be noted that companies that are registered as public companies must follow the IFRS procedures, as of 2011;

- investors can benefit from tax deductions on the disposal of shares under the Lifetime Capital Gains Exemption, regulated under the Section 110.6 of the Income Tax Act;

- according to the Government of Canada, for 2022, the threshold for the disposal of qualified small business corporation shares was $913,630.

Our team of specialists in company incorporation in Canada can offer further information on other matters concerning the accounting procedures and obligations that can be applied to a Canadian holding. Please know that you can also rely on us if you need information the intra company transfer in Canada.

This is a work immigration program addressed to certain categories of employees who work for businesses that have set up subsidiaries or branches, which, in other words, belong to the same owners, and this can also be the case of holding companies.

The Canadian holding company can also be an excellent estate planning tool. It can also register for VAT in Canada. We invite you to watch our video on the Canadian holding company:

We can also provide details on the owner operator program in Canada. If you want to register a holding company and need assistance, please feel free to contact our company incorporation advisors in Canada.