Many foreign companies are interested in expanding their operations in other countries once they’ve achieved maturity and their profits allow them. While some of them choose the European market, there are also those willing to venture into the American or Canadian markets.

Foreign companies seeking to expand their business activities in Canada can set up subsidiaries or branch offices. The main difference between these types of structures is the degree of independence of the Canadian company. Our company formation consultants in Canada can offer a clear definition of the subsidiary company. Foreign business owners can rely on us for assistance in registering a subsidiary company in Canada.

Canadian legislation on subsidiary companies in Canada

The main law that provides for the establishment of a company in Canada is the Company Act, however, it contains specific regulations for those who want to expand their businesses here. There are also provincial and territorial regulations that determine the conditions under which such expansions are possible. Among these, Alberta, Labrador, Manitoba, Newfoundland, Ontario, and Saskatchewan have had specific requirements under which at least 25% of a subsidiary’s directors must be Canadian residents. However, many provinces, including Ontario, Alberta or Saskatchewan have renounced this requirement, which means that investors are no longer facing any restrictions when setting up a business in 2024.

Depending on the province or territory you plan on expanding your business through a subsidiary, you can obtain the necessary information about the requirements from our Canadian company formation specialists.

Business forms available for registering a Canadian subsidiary in 2024

Compared to other jurisdictions, Canada has more types of legal entities that can be used for the creation of a subsidiary. Among these, the corporation which is the equivalent of the limited liability company is often used, however, there are also other business forms that can be used, among which the extra-provincial corporation, the partnership, and even the trust.

The choice of the legal entity will depend on whether the subsidiary will be incorporated at a federal or provincial level. Where the business owner decides for the Canadian subsidiary to operate at a provincial level, it should be noted that the company must be registered in each province or territory it will offer its services or sell its goods.

Setting up a subsidiary in Canada is slightly different from other countries, which is why we invite you to discuss your options with our local agents once you make a decision.

Requirements to create a Canadian subsidiary company

The subsidiary company has a certain degree of independence in relation to the parent company, however, this independence is granted by the foreign company. When setting up a subsidiary company in Canada, a foreign entity must take into account the following requirements:

- the company must be registered under the federal or regional legislation depending on where its seat will be and the market it will address;

- the foreign company must choose the type of subsidiary it wants to create;

- the parent company must take into consideration the residency of the subsidiary directors;

- subsidiary companies are tax residents of Canada, therefore they will pay their taxes in this country.

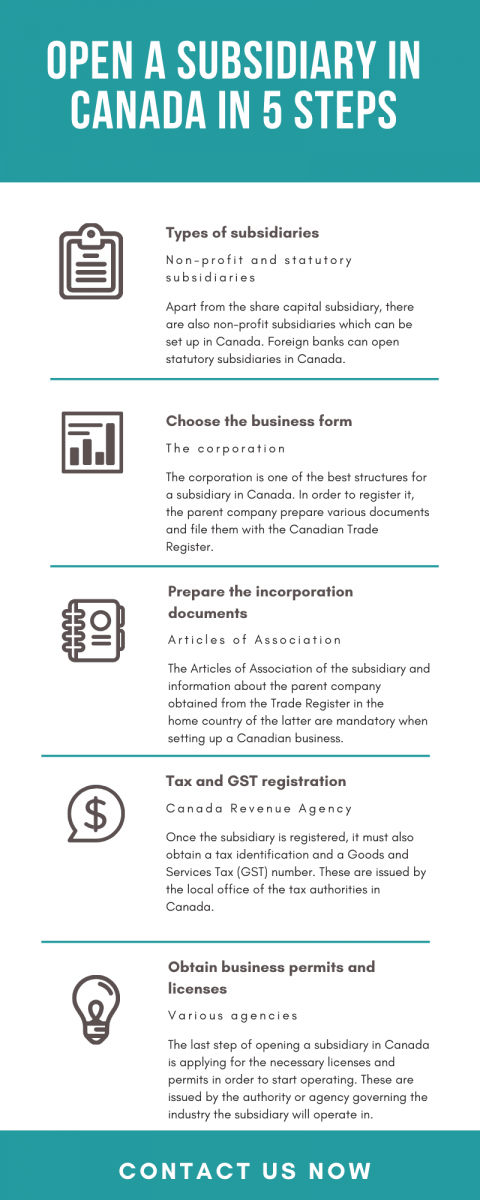

With respect to the types of Canadian subsidiaries, these can be:

– non-profit subsidiaries;

– subsidiaries with share capital;

– statutory subsidiaries which apply in the case of foreign banks.

Our company registration agents in Canada can explain the requirements related to subsidiary directors. Subsidiaries are also required to register for VAT in Canada.

You can also read about the creation of a subsidiary in Canada in the scheme below:

Articles of Association when opening a subsidiary in Canada

The creation of a Canadian subsidiary will imply drafting its statutory documents under the form of Articles of Association. These must contain information about the shareholders, the company officers, and the activities of the company. Also, the place of registration and legal structure of the subsidiary must be mentioned in these documents.

An important aspect to consider is that the statutory documents can be altered if the shareholders want to change the legal entity under which the subsidiary is to be set up. However, the changes must be made through the Articles of Amendment.

If you plan on starting a business in Canada and need guidance on choosing the business form, our consultants can advise you.

Registering a subsidiary in Canada in 2024

The most common type of structure for creating a Canadian subsidiary is the corporation. The next steps are required to complete the subsidiary registration procedure in Canada:

- carry out a name search report in order to make sure the trade name is unique;

- prepare the documents related to company registration, which include the articles of association and the bylaws;

- filing the documents with the provincial or federal Trade Register;

- obtaining a tax identification number from the same Companies Registrar;

- obtain the necessary licenses and permits related to start operating.

After the company is registered, it must comply with certain requirements imposed by the local Trade Register. Among these, maintaining a corporate minute book and making changes in the company in accordance with the Company Law. It is will also be required to file annual returns with the Canadian Revenue Agency.

Accounting requirements of the subsidiary in Canada in 2024

The following accounting requisites must be considered by foreign companies opening subsidiaries in Canada:

- it will be subject to the income tax applied at the federal and provincial level;

- the taxation will be applied to the income generated at a global level;

- the subsidiary company will be subject to the accounting and reporting requisites applied in Canada;

- the subsidiary can benefit from tax credits against the taxes paid on the income generated in other countries than Canada;

- the subsidiary company will benefit from the provisions of the Canadian double taxation agreements;

- certain tax benefits are granted for the repatriation of capital gains.

Non-profit subsidiaries in Canada

Foreign investors have several choices when it comes to the opening of subsidiaries in Canada, as these can be registered as non-profit or for-profit companies. When created as non-profit entities or charities, subsidiaries make an excellent tax planning tool.

Those who want to obtain tax benefits in Canada can register tax-exempt companies under the form of one or more controlled corporations deemed as subsidiary companies. In this case, the tax-paying entity will act as a holding company with subsidiaries in Canada.

Subsidiaries can also take the form of non-profit organizations and benefit from tax exemptions under the Income Tax Act, however, they must comply with various requirements. These requisites are:

- for the subsidiary to be registered as a club, society or association;

- for it not to be registered as a charity;

- for it to operate exclusively for social, civic or recreational reasons or other purposes which do not imply making any profit;

- for it to not distribute any benefits under the form of income to members or shareholders.

Our consultants in Canada can assist with the registration of a subsidiary for non-profit purposes.

Foreign companies operating in Canada

According to Statistics Canada, at the level of 2017, the number of Canadian companies with foreign ownership across all industries was quite important. The report indicates that:

- the total number of foreign-owned enterprises was 1,801,622;

- out of these, there were 1,790,072 small companies;

- there were also 8,571 medium-sized entities;

- the number of large foreign-owned companies was 2,979.

In comparison, by 2022, the year when the latest data have been made available, Canada accounted for 1,902,388 companies, the majority being comprised of SMEs (1,886,762 companies), which shows positive trends for those interested in investing here in 2024.

Are there any new tax updates in Canada in 2024?

Yes, the tax legislation was recently modified for certain regions of the country. Thus, businesses that are registered in the Prince Edward Island or which carry business operations here must know that the lower income tax rate was decreased starting with 1st of January 2021. The tax was reduced from 3% to 2% and it is applicable to the income earned in Prince Edward Island for entities that qualify as small businesses, entitled to this federal tax deduction. Additionally, one has to know that the businesses are charged with a lower tax starting with 1 January 2022, reduced from 2% to 1%.

The personal taxation system (at a national level) has also suffered important modifications in 2024. The tax brackets were adjusted with the inflation and the standard tax rates, of 15%, 20.5%, 26%, 29% and 33% are now imposed to different income levels.

In 2024, the income below $55,867 is charged with the 1st tax rate (as opposed to $55,359, income between $55,867.01 to $111,733 is charged with the 2nd tax rate (as opposed to $53,360 – $106,717), income of $111,733.01 to $173,205 is charged with the 3rd rate (as opposed to $106,718 to $165,430).

The 4th tax rate is applied in 2024 to income of $173,205.01 to $246,752 (compared to 165,431 to $235,675). The 5th is imposed to any income above $246,752.01 in 2024.

Please mind that in certain Canadian regions the personal income tax can be charged at different rates. For instance, in Prince Edwards Islands, the personal income tax in 2024 varies from rates of 9.65% to 18%.

FAQ on opening a subsidiary corporation in Canada

1. Is it hard to register a subsidiary in Canada?

The company registration procedure of a Canadian subsidiary will be completed just as in the case of a corporation, therefore it is not complicated.

2. Must a subsidiary be registered at the federal or provincial level?

Foreign companies are allowed to register subsidiary companies at both federal and regional levels.

3. Which one is best: federal or territorial incorporation of a subsidiary?

Both registration options are advantageous, however, it should be noted that certain provinces do not impose any residency requirements for company directors. Among these are Quebec, British Colombia, and Nova Scotia.

4. Are nominee directors allowed for Canadian subsidiaries?

Yes, nominee directors can be employed when opening a subsidiary in Canada.

5. Are there any other business forms available for registering a subsidiary in Canada?

Yes, in certain provinces, such as Alberta, Nova Scotia, and British Colombia, subsidiaries can be registered as unlimited liability companies. In other provinces, these can be registered as trusts or partnerships.

The video below shows the main steps for opening a subsidiary in Canada:

Our company formation advisors in Canada can assist with the preparation of the documents needed to set up a subsidiary company in this country. Please feel free to contact us if you need information about the taxation of Canadian subsidiaries.

Our consultants can also present information concerning the taxation of other business types. For instance, if you will set up a business in Canada as a partnership, the tax system will be different from the one of a subsidiary.

Taxes charged to businesses can also vary based on the region where the company operates, as well as based on the type of taxes applied to the business (lower rates or standard rates).

Companies can benefit from tax exemptions, tax reductions and deductions and these can vary over the years, in accordance with the tax laws approved for each financial year.

Our accountants in Canada can help businesses assess their overall tax obligations and establish the tax minimization they are entitled to, so you are invited to address to our specialists for professional accounting services.

You are also invited to contact our team in the case you need legal advice on how to participate in various immigration programs designed for business/work.

Our team can help you prepare the documentation required for the Owner Operator program in Canada and assist you in the formalities you must complete once the application form is submitted with the Immigration Canada.

Further on, you can also send your inquiries to our team if you want to know what the conditions are to fulfill for the Intra Company Transfer in Canada.

The program aims at highly skilled employees working in multinational companies that have a subsidiary/branch office operating in this country. Applicants can obtain a response after they send their application in a period of 1-2 months.