If you need VAT registration services in Canada, you can rely on our team of specialists. Our consultants can help local and foreign investors in preparing the documentation for VAT registration, in the relation with the Canadian authorities and in other matters related to VAT compliance.

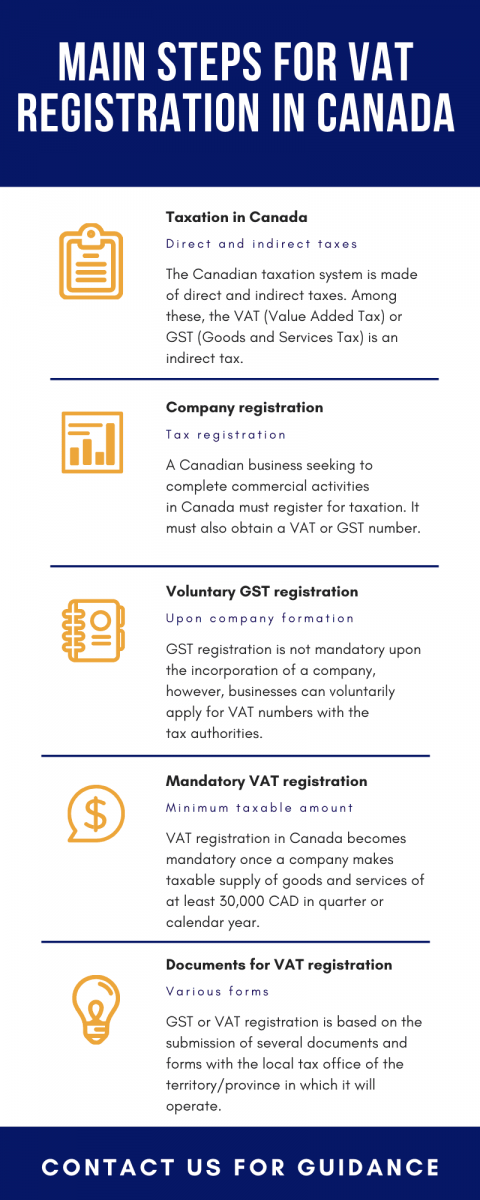

The Canadian taxation system is made of direct and indirect taxes. The most important indirect tax is the value added tax (VAT), however, in Canada, it is known as the Goods and Services Tax (GST).

In certain provinces, the GST is known as the Harmonized Sales Tax (HST) and in order to collect this tax, a Canadian company or individual is required to register for VAT with the tax authorities.

Please know that the GST payments have to be made throughout the entire financial year, which, in Canada, is the same as the calendar year. The financial year can also vary based on the nature of the GST payer. Therefore, if you need to pay GST in 2024, you will need to follow the calendar year if you are a natural person, an entity registered as a trust or a partnership.

A corporation can also use the calendar year for GST purposes, but it must be noted that if the company has a different fiscal year, the respective interval can be used for GST payments as well. However, if this is the case, the Canadian Revenue Agency must be informed on the preferred fiscal year that the corporation wants to opt for.

In order to understand how VAT registration works in Canada, our local consultants have prepared a guide on this important tax. We can help foreign investors who want to set up companies and register for VAT in Canada.

What are the company registration obligations of a foreign VAT payer in Canada?

When starting a business activity in Canada, foreign companies usually will register a legal entity following the Canadian company law applicable in the Canadian province of choice.

However, in practice, some foreign companies will only want to sell or enter into various contracts with local buyers and companies and this will be their only business connection with Canada.

But when the latter scenario occurs, this will imply certain tax obligations for both parties involved in the transaction. The foreign company will also have tax obligations in Canada, due to the fact that it will supply/sell various services or products here.

This will create the obligation for VAT registration in Canada as per the rules of the province where the business activity occurs.

It must be noted that, depending on the country, when foreign companies will only trade goods with local buyers, they will not have to complete the registration of a local legal entity in order to have the right to develop a business activity.

In other countries, this will create the obligation to first register a legal entity, and then to register for taxation purposes. In Canada, foreign companies are not obligated to incorporate a new legal entity for the purpose of developing certain taxable activities.

This implies that the foreign company will not have to go through the process of company formation in Canada in order to have the right to trade. However, the obligation to register for VAT in Canada will appear, if the activity is a taxable one.

Foreign companies will be taxed in accordance with their tax residency, and foreign entities have 2 options in this sense:

- to operate through a permanent establishment;

- to trade goods/services without a permanent establishment.

The obligations deriving from these 2 options are regulated under in the Subsection 123(1) of the Excise Tax Act.

It is also important to know that foreign companies are not required to appoint a tax representative, but they can always request the assistance of our team of consultants in company incorporation in Canada for tax registration services.

What are the VAT registration requirements for foreign companies in Quebec in 2024?

Quebec is one of the most important regions of Canada, a place which attracts many foreign investments. In Quebec, local and foreign companies are required to pay 2 types of VAT.

One is the basic GST, charged at a rate of 5%, and the second one is the Quebec Sales Tax (QST), charged at a rate of 9.975%. These 2 taxes are imposed to all services and products sellers and suppliers, if they qualify for the payment of the tax.

The rule is applied to foreign entities as well. Please mind that the procedure for VAT in Canada is mandatory in Quebec for non-resident companies. For instance, foreign businesses that are considered suppliers of digital products to Quebec residents, must register for VAT.

Are foreign businesses required to apply for a Canadian Business Number?

A step in the process of company formation in Canada is the issuance of a business number. Local companies need to receive a business number, and the same applies to foreign companies operating here.

According to the law, companies that must register for VAT in Canada must also have a business number, regardless if they are required to register for VAT or if they have opted to register on a voluntary basis.

For foreign companies which are not residents of Canada, it will be necessary to apply for this number by completing the Non-Resident Business Number and Account Registration Web Form.

It is also important to know that for some non-resident business the online registration is not available. In this case, one can complete the VAT registration in Canada through the physical offices of the Tax Service Office.

Certain offices will deal with applicants from certain countries, so foreigners should verify the list of offices where they can address. For instance, the office from Nova Scotia is available for non-resident companies from Albania or Azores.

Voluntary VAT (GST) registration in Canada for non-residents in 2024

Non-resident companies can register voluntarily for VAT in Canada under the GST regulations. These can register in one of the following situations:

- they order goods or services which are exported or delivered in Canada;

- they have entered agreements for the supply of goods and services in Canada;

- they have entered agreements related to the use of intangible or real estate property in Canada.

Our local advisors can also help non-resident investors interested in starting a business in Canada.

When is VAT (GST) registration required for local businesses in Canada?

A person or business is required to register for VAT in Canada at the moment they start to make taxable supplies. It is worth noting that trusts and associations are also required to register for VAT in Canada in case they sell goods or services.

VAT registration is not mandatory until the entity or individual has made taxable supplies of goods and services of at least CAD 30,000 in a quarter or a calendar year. If this amount of money is not reached, the applicant can register for GST/HST/QST voluntarily.

There are also special rules related to VAT registration in Canada. These apply to charities, taxi companies and non-resident book and magazine sellers and publishers entering Canada for a limited period of time.

Our team can offer more information on the special requirements related to GST/HST/QST registration.

VAT (GST) registration regulation in Canada

There are several laws which provide for the levy of the value added tax in Canada. While the most important one is the First Nations Goods and Services Tax Act, there are also other laws that provide for the registration requirements applied to Canadian businesses with respect to the GST.

Also, there are several principles to be respected upon the collection of this tax. The first one refers to the types of products the tax is applied, to the destination of the products or services and the beneficiaries. Companies in Canada are required to register for VAT in the provinces they are established in.

The VAT in Canada bears different names depending on the region it is levied in, as it follows:

- the GST is the federal tax which is levied a national level in every province and territory;

- the Provincial Sales Tax (PST) is levied in every province, except in Alberta;

- the GST and the PST combined is called the Harmonized Sales Tax (HST) is levied in New Brunswick, Newfoundland and Labrador, Nova Scotia, Ontario and Prince Edward Island;

- there is also the Quebec Sales Tax (QST) which is levied alongside the GST;

- in Manitoba, the provincial sales tax is called Retail Sales Tax (RST) and is levied together with the GST.

Companies are required to register for the VAT, however, when it comes to the collection of the tax, they must collect the taxes in the provinces they are incorporated in.

Our company formation specialists in Canada can guide foreign investors who want to set up companies through the VAT registration procedure.

Entities required to register for VAT in Canada

Companies supplying goods and services exempt from the VAT cannot apply for GST or HST accounts in Canada.

There are two mandatory conditions to fulfill in order to be allowed for VAT registration in Canada: for the company not to be a small supplier and for the taxable goods and services to be supplied in Canada.

Other than that, the following entities are required to register for GST/HST in Canada:

- companies selling good and services subject to the VAT in Canada;

- charities and public institutions that make more than CAD 50,000 in a calendar year;

- non-resident companies interested in applying for GST registration in Canada;

- taxi operators and financial institutions have specific GST registration requirements to comply with.

As mentioned above, VAT registration is not required for small suppliers. In order to determine if a company is a small supplier or not, it must meet certain requirements.

Individuals whose revenues derived from worldwide supplies of goods and services do not exceed CAD 30,000 per quarter are considered small suppliers. In the case of public institutions, the minimum amount is set at CAD 50,000. In the case of charities, the revenues must not exceed CAD 250,000 in a quarter.

Our local agents can offer more information on the VAT registration requirements applied to special categories of taxpayers in Canada.

Documents required for VAT registration in Canada in 2024 for locals and foreigners

In order to register for GST/HST/QST in Canada, a company, entity or individual is required to file a few documents with the tax authorities.

Among these, the application form (Form RC1 or RC1A depending on the situation), the company’s registration documents (where applicable), the GST/HST questionnaire in the case of non-resident companies and non-resident investors.

It is also good to know that non-residents could be required to provide security upon the registration for VAT in Canada.

VAT registration requirements are different across Canadian provinces and territories, this why it is good to request specialized services in this sense. For non-residents in need of registered agent services, our Canadian agents can be of help.

New GST/HST rules for Canadians and foreigners

Starting with 1st of July 2021, entities that are registered as e-platforms operators (or which are considered to be so) will need to follow new regulations regarding GST/HST in Canada. This applies to both Canadian residents as well as to foreign residents.

Thus, these entities will need to collect data on their clients as well as on their customer’s clients in order to verify if the GST/HST is applicable and who is liable to the payment of this tax.

New regulations apply in Canada since 1 January 2022 with regards to the proposed digital services tax, that is charged at a rate of 3%.

Who must pay the VAT in Canada?

The value added tax is applied on most goods and services bought by the population, however it is collected by companies in Canada and forwarded to the tax authorities. In order to be able to collect the VAT, a company must have a GST number and account attached to it.

Foreign companies selling goods and services in Canada must also register for VAT as long as the taxable supplies exceed CAD 30,000 in any quarter of the year.

In order to simplify the collection of the GST, it should be noted that the Canada follows the OCED standards which is popular in all European countries.

The VAT (GST) in Canada

In order to understand how VAT registration must be completed by Canadian companies, sole proprietorships and individuals involved in the sale of goods and products, one must first understand how this tax applies considering the complex taxation system of this country.

Here is what one should know about the Canadian VAT:

- the GST is levied at a federal level and it applies to all taxable goods and services;

- the HST combines the federal and provincial VAT and it is applied at different rates;

- the HST is levied in Ontario, New Brunswick, Newfoundland and Labrador, Prince Edward Island and Nova Scotia;

- Quebec has its own VAT levied under the form of the Quebec sales tax or QST;

- British Columbia, Saskatchewan and Manitoba impose provincial sales taxes (PST).

VAT registration must be completed with the local tax office in the province/territory the business is registered in. The same principle applies to individuals selling goods and services in Canada. For example, those paying the QST must register with the Quebec Revenue Agency.

Our company formation agents in Canada can offer more information on how to register for VAT. We have also created a scheme related to VAT registration in Canada.

Advantages of GST registration in Canada in 2024

Even if GST registration is not mandatory up to a point, Canadian companies applying for VAT numbers voluntarily can obtain various advantages.

One of the most important benefits is the input tax credit which can be claimed in order to recover the GST/HST paid during the commercial activities. Also, these credits can be claimed within up to 4 years from the end of the period in which the tax credit could have been requested.

The rules for claiming VAT input tax credits are the same as for claiming various business expenses in Canada. VAT claims can be requested for rental activities, various utilities, office supplies and even for specific employment-related expenses.

With respect to the reporting periods for GST payments, it is important to note that the Revenue Agency will assign a company’s reporting period based on the total annual sale of taxable goods and services. The period can be monthly, quarterly or yearly.

The reporting period will be assigned for the previous financial year upon VAT registration in Canada. It is possible for companies to choose their reporting periods based on VAT-taxable incomes.

Also, companies are required to meet the filing deadlines in accordance with the reporting periods in order to avoid penalties. Reporting is also required even if a business did not conduct any commercial activity or collected any VAT during the respective timeframe.

When referring to the penalties a company can be charged with when it comes to late submission of forms and declarations, you must know that there are certain formulas that are applied in this case.

If you need to submit VAT reports in 2024, you have to know that you will pay a fine that follows this formula: A+(Ax0.25xC). A defines the outstanding amount the company needs to pay and it is calculated at 1% of the respective value.

C refers to the number of months since the VAT payment is overdue. However, the respective period of time can’t be longer than 12 months. We invite you to contact our team if you need assistance on the payment of overdue VAT in 2024 and of any other corporate taxes.

The GST returns that must be sent to the Revenue Agency must contain information on the amount of money charged on the customers and the amount paid or owed to the suppliers. The difference between these charges represents the net tax paid by the company.

VAT (GST) rates and filing requirements in Canada

The VAT is imposed at different rates in Canada, while the filing requirements are also different. Here is what you need to know about VAT rates and filings in Canada:

- the GST is levied at a rate of 5% (a reduced rate of 0% is also available for certain goods);

- the HST is levied at rates between 13% and 15% (with a reduced rate of 0%);

- the QST is imposed at a rate of 9.975%;

- the PST is levied at rates ranging between 6% and 8%;

- GST/HST/QST/PST filings can be submitted monthly (so, 12 times a year), on a quarterly basis (4 times a year) or on a yearly basis.

Legislation related to the VAT in Canada

There are several laws which provide for how the GST in applies in Canada. These are:

- the First Nations Goods and Services Tax Law;

- the Excise Tax Law;

- the GST/HST Rulings, where HST stands for Harmonized Sales Tax;

- the GST/HST Policy Statements.

According to the law, the VAT in Canada applies based on the following principles:

- the type of products or services;

- the destination of the services or products;

- who the beneficiary of the products or services is.

Our consultants can offer more information on the legislation related to the value added tax.

For assistance in VAT registration in Canada, please contact our company formation agents.